The EU Parliament approved the Markets in Crypto-Assets (MiCA) law today, April 20th, bringing regulatory clarity to the European crypto-asset industry.

In a Medium article dated April 4, 2023, XDC Foundation reviewed the Trade Finance Distribution Initiative’s (TFDi) blueprint for trade distribution. Two debates held by industry leaders in 2019 and early 2023 focused on the need for expanded trade distribution channels that will allow institutional and retail investors to participate in the low-risk trade finance asset class. Global trade, in general, will benefit from a broader secondary market and will inject much needed liquidity into the trade finance sector.

Blockchain, and specifically XDC Network, already has a role in this expansion with its technological capabilities, as evidenced by the first trade finance NFT launched on the network in 2019 and the TRADA Token — a tradable and regulated trade finance digital asset — launched in 2022.

The TFDi debates concluded that a Securitization-as-a-Service (SaaS) solution would provide a serious platform for trade distribution expansion. Blockchain technology will most likely underpin this effort as well.

~

In 2017, the United Nations Commission on International Trade Law (UNCITRAL) established the Model Law on Electronic Transferable Records (MLETR) to promote the use of electronic records for domestic and international trade — records that would replace paper-based transferable documents. Such documents include bills of lading, bills of exchange, promissory notes, and warehouse receipts.

For centuries, trade has relied on paper documents as tangible evidence of originality and ownership. In the past 40 years, the rise in e-commerce has shown the benefits of electronic transactions. Dealing with paper-based documents in global trade can bog down an entire supply chain, one that has seen its share of problems in recent years. Thus, the adoption of MLETR and Digital Document (dDOC) specifications has become increasingly important.

In February 2023, industry leaders gathered to discuss a blueprint for Digital Negotiable Instruments (DNI) and the progress of the DNI Initiative. The debate was held in Dubai during Global Trade Review’s Middle East and North Africa event (GTR MENA). Similar to the TFDi debates, these leaders outlined priorities needed to meet the DNI Initiative’s objective in promoting global adoption of MLETR.

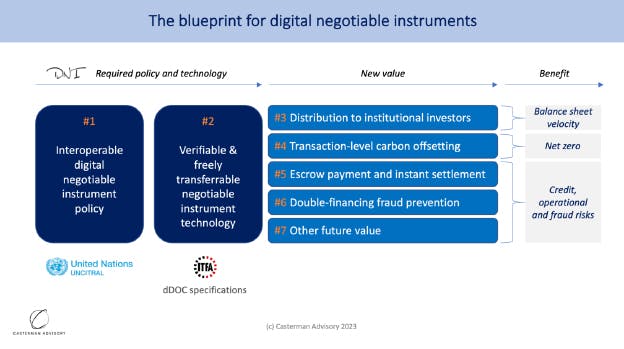

Led by trade finance expert André Casterman, the tradetech group included members from SABB, HSBC, Kyriba, Emirates NBD, SMBC, and ITFA. The group focused on achieving three strategic outcomes as outlined by five priorities for the blueprint for digital negotiable instruments:

1. Increase origination volumes.

2. Generate new revenue streams.

3. Boost the addressable market for Supply Chain Finance.

Five priorities for the blueprint for digital negotiable instruments

1. Align policy to technological developments. Legislative adoption of MLETR is essential in creating the intricate digital string of documents needed for digitizing global trade. These documents must be legally enforceable. The group noted that Middle Eastern policy makers were among the first to embrace MLETR since its publication in 2017 by delivering two of the initial jurisdictions — Bahrain in 2019 and ADGM in 2021.

The policy adoption priorities are as follows:

Embrace new policies around electronic transferable records.

Digitize negotiable instruments in the most interoperable way.

Add new value at the transaction level.

We piloted the DNI Initiative and validated that the additional MLETR technology is pretty simple to use. The impact on business practices is minimal which is a major benefit.

2. Focus on interoperability to scale use of the new practice. Embracing interoperable technologies promotes MLETR’s scalability. Although cloud platforms and APIs perform well with industry-governed specifications and software interfaces, on their own they are not sufficient to achieve DNI’s objectives. Digital Ledger Technology (DLT) and digital assets provide the asset and value transfer aspect needed to extend open banking (sharing financial data) practices.

3. Add new value to digital flows. Some value-add examples include:

Automated securitization for sale of assets to institutional investors.

Programmable transaction-level carbon offsetting.

Escrow payment and instant settlement.

Double-financing fraud prevention and more to be developed by the market.

When digitization begins to scale, extending further benefits to the digital process will be critical in sustaining its growth. The benefits can be seen in the following chart:

4. Promote open platforms and ecosystems. While closed ecosystems have worked in most applications to date, trade is trending towards an open ecosystem. A bill of exchange or bill of lading should be able to navigate from one platform to another as a self-contained and verifiable digital asset.

Platforms will need to embed the DNI Initiative’s dDOC specifications and become interoperable at the negotiable instrument level. Trust must be embedded in the electronic record of that instrument. With the open ecosystem, the parties can then use their individual preferred software solutions.

DLT is a 21st-century innovation that needs to be embraced with a 21st-century open banking mindset; that’s where most trade-focused consortia have failed so far (not only the bankrupt ones).

5. Expand Supply Chain Finance. As trade is global, so are the financial instruments that accompany it. These instruments must be able to function across multiple jurisdictions.

The tradetech group noted that a Bill of Exchange (B/E) is a time-honored multiple jurisdiction financial instrument that extends credit from a seller to a buyer. It works, and it is a comfortable solution that does not require additional documentation for buyers to review. Other financial instruments, however, are more complex and cumbersome. Digitizing B/Es can potentially revolutionize the trade finance workflow.

What is blockchain’s role in advancing digital trade?

Trust is listed in one of the tradetech group’s priorities as an essential component of digitizing trade transactions. Blockchain technology provides the technological foundation for the transactions and the electronic records they represent. Blockchain is a trustless system which means that the way transactions are encrypted and added to the blockchain — immutable and everlasting — eliminates the need to establish trust through paper documents managed by centralized parties.

Proving originality and ownership is an underlying concern in moving away from a paper-based documents system. Blockchain solves this dilemma. Public records can be recorded as such on the blockchain and recalled as verifiable proof when needed. Alternatively, private records can be recorded privately and seen only by those with permission. In either case, the records are recorded as immutable and everlasting, as they should be.

Markets in Crypto-Assets (MiCA), the EU’s new comprehensive crypto law

MiCA was approved by the EU Parliament today (April 20th) and brings regulatory clarity to the European crypto-asset industry that does not exist in countries like the U.S. Its main provisions will be enacted just over 12 months after publication in the EU’s official journal, likely in June 2023. The MiCA legislation means that the EU will have a unified approach to crypto asset regulation across all 27 member states, making it possible for firms approved in one country to “passport” their business into others with minimal additional paperwork.

MiCA offers the DNI Initiative an attractive extension through the use of on-chain settlement on the basis of regulated stablecoins, for instance.

In summary

Digitizing records in global trade is a heavy undertaking, yet the commitment to achieving that is as focused as ever. And there is progress to show for it. For example, the UK Parliament is actively legislating a bill to provide for electronic trade documents. As of this writing, the bill has already passed the House of Lords, where it started, and is now under consideration in the House of Commons. English law provides the historical basis for nearly 40% of the world’s legal systems, and passage of this bill should have a wide-reaching impact on global trade.

As blockchain technology becomes well-established as a viable solution that works with legacy systems and not against them, further progress will be achieved. And one of the most dynamic outcomes of DNI Initiative’s ultimate successes will be a blueprint for digitizing many more enterprise applications across multiple sectors.

READ more from XDC Foundation on Medium